A U.S. judge is expected to decide Tuesday whether Detroit can proceed with its record bankruptcy to shed billions in debt.

A ruling that the city can seek court protection from its creditors could open the door for big cuts in payments promised to employees, retirees and investors.

Unions and pension funds have argued that Detroit should be denied the protection of the court. They say that regardless of the city's financial troubles, officials did not negotiate with creditors in good faith to reach a deal on Detroit's debts. That is one of the conditions for a city to proceed in bankruptcy court.

A ruling by Judge Steven Rhodes that Detroit is not eligible to use bankruptcy court would raise questions about the city's finances going forward.

Any ruling is expected to be appealed.

The city's unions and pension funds have been fighting proposals to slash benefits owed to employees and retirees.

Detroit filed for bankruptcy court protection on July 18, making it the largest municipal bankruptcy case in U.S. history.

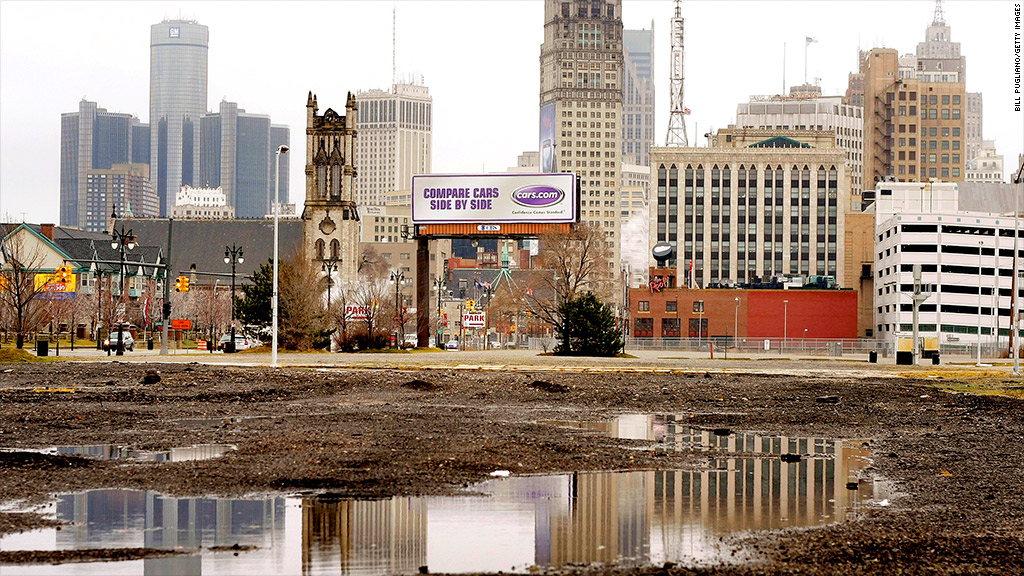

Once one of the nation's largest cities, Detroit was a symbol of U.S. manufacturing might. But decades of declining population and the departure of businesses has left it struggling with high crime, high taxes and poor city services.

Emergency Manager Kevyn Orr, who was appointed by Michigan Gov. Rick Snyder in March to oversee the city's finances, has proposed slashing more than $9 billion of $11.5 billion in unsecured debt in order to fix the city's finances.

But Orr's plan would mean deep cuts to the pension benefits and retiree health care coverage that has been promised to city employees. It would also mean investors holding debt issued by Detroit would receive only pennies on the dollar.